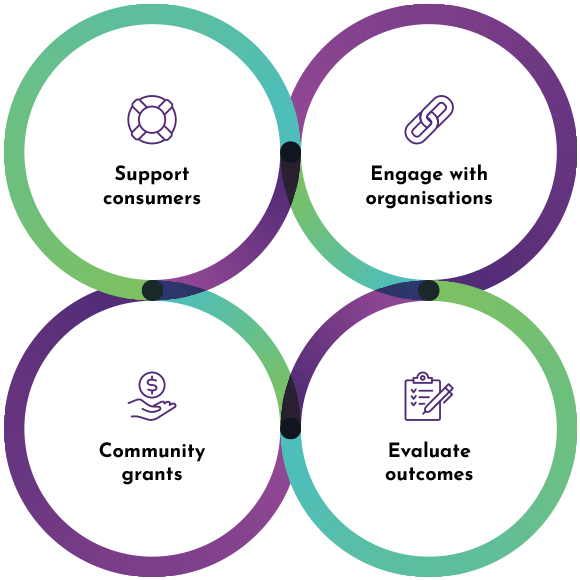

We focus on four impact areas: financial education, strong communities, consumer care and collaboration.

Ecstra provides grants to develop and deliver financial education in schools, at home and other learning environments. We also support organisations building community financial wellbeing, improving consumer outcomes and helping those in financial need. We measure, evaluate and share our outcomes and insights.

Ecstra collaborates with government, consumer groups, communities, industry, educators and researchers as part of the National Financial Capability Strategy, led by the Australian government.

Money lessons for life

Financial education and learning about money is a lifelong journey. Ecstra wants to ensure that more Australians including children and young people have access to effective financial education, and guidance when they need it.

This is why Ecstra partners with a range of organisations and educators, often already active in schools, communities and workplaces. They share our passion for financial education and equality of access – ensuring that more people from all backgrounds and at all life stages get the opportunity to learn key money skills, to be confident making financial decisions and to plan their financial future.

Talk Money with Ecstra Foundation

Talk Money provides an introduction to money and key finance concepts for primary and secondary school students. The workshops are designed to be inclusive and relevant for students of all backgrounds and experience.

The program is open to schools across Australia. We are committed to ensuring schools with ICSEA scores <1000, including students experiencing disadvantage are prioritised for participation.

Talk Money Advisory Group

Talk Money has been developed by education experts in collaboration with a financial education advisory group providing diverse experience, insights and feedback. We appreciate and acknowledge the contribution of the following advisory group members:

- Rachna Bowman, Senior Practitioner for the Financial Wellbeing Program at South East Community Links

- Allan Dougan, CEO of the Australian Association of Maths Teachers (AAMT)

- Grace Draper, Youth National Reference Group of headspace

- Janine Farah, National Operations Manager, Young Change Agents

- Amber Finn, ABCN Accelerate program

- Rachel Noonan, 2020 Premier’s First State Super Financial Literacy and Capability Teaching Scholarship recipient

- Dr Tracey West, Lecturer at Griffith University Business School

Our program approach

Knowledge is not enough

We understand that financial decision making is driven by multiple factors, of which knowledge is just one. We aim to go beyond information provision and focus on developing attitudes, skills, self-efficacy and an enabling social context.

Make relevant for student

We recognise that students come to the classroom with different experiences, beliefs, cultural backgrounds and values. We aim to embed inclusivity throughout our workshops, and provide space for students to ‘bring themselves’ to the workshops.

Spark conversation

One of the most important financial capability skills is the ability to talk about money, ask questions, discuss preferences and ask for help. Throughout the program we aim to provide opportunities for financial conversations and develop skills for students to do this independently.

Collaboration is key

We understand that building the financial capability of young Australians must be a shared responsibility, and our program is just one piece of the puzzle. We aim to share other organisations’ resources and support teachers to continue reinforcing lessons in the classroom.